Have you ever noticed strange transactions in your business accounts and wondered how no one caught them sooner? Imagine a small business where the owner is busy managing day to day operations. One day, they notice that some payments seem unusual, but it is hard to tell if it is a mistake or something more serious. By the time they investigate, valuable money is already gone and the trust of their team and clients is at risk.

Fraud can happen in any business, whether small or large and it can affect finances, damage trust and disrupt operations. Many businesses face this problem because they react only after something goes wrong.

Using IT audit for detecting fraud in businesses provides a solution. With a proper audit, companies can spot suspicious activities early, secure sensitive information and prevent financial losses. Preventing fraud in businesses with IT audits and relying on professional IT audit services helps keep systems secure, ensures employees follow proper procedures and reduces risk significantly.

If you want to protect your business and uncover hidden risks before they escalate, book a free consultation with TECHOM Systems to take the first step toward securing your business effectively.

Why IT Audit For Detecting Fraud In Businesses Matters?

Fraud can strike any business, big or small and often goes unnoticed until it causes serious problems. Many companies struggle to catch unusual transactions, unexpected access to sensitive data or odd activity in their systems.

IT audit for detecting fraud in businesses helps organizations identify these risks early and take corrective action. Conducting regular audits allows companies to protect their finances, maintain trust with clients and employees and ensure smooth operations. Below are some key reasons why IT audits are essential for preventing fraud:

- Early Detection of Fraud

By reviewing systems and financial records systematically, businesses can spot suspicious activities before they escalate into major losses. Fraud detection through IT audits ensures potential issues are addressed quickly and efficiently. - Securing Sensitive Information

Many businesses store critical data such as customer information, financial records and business plans digitally. Preventing fraud in businesses with IT audits helps safeguard this information from unauthorized access or breaches. - Improved Compliance and Governance

Regular IT audits ensure that companies follow industry regulations and internal policies. This reduces legal risks and strengthens organizational accountability. - Minimizing Financial Losses

Detecting and addressing fraud early helps businesses avoid significant financial losses. Following a structured audit process allows companies to identify irregularities and resolve them before they impact overall performance. - Building Trust with Stakeholders

When businesses implement professional IT audit services, clients, partners and employees feel confident that systems are secure and that the organization prioritizes integrity and transparency.

Regular IT audits help businesses prevent fraud, protect sensitive data and maintain trust, ensuring risks are managed before they become serious problems.

Free Tips For You: Effective Ways To Reduce IT Cost For Businesses

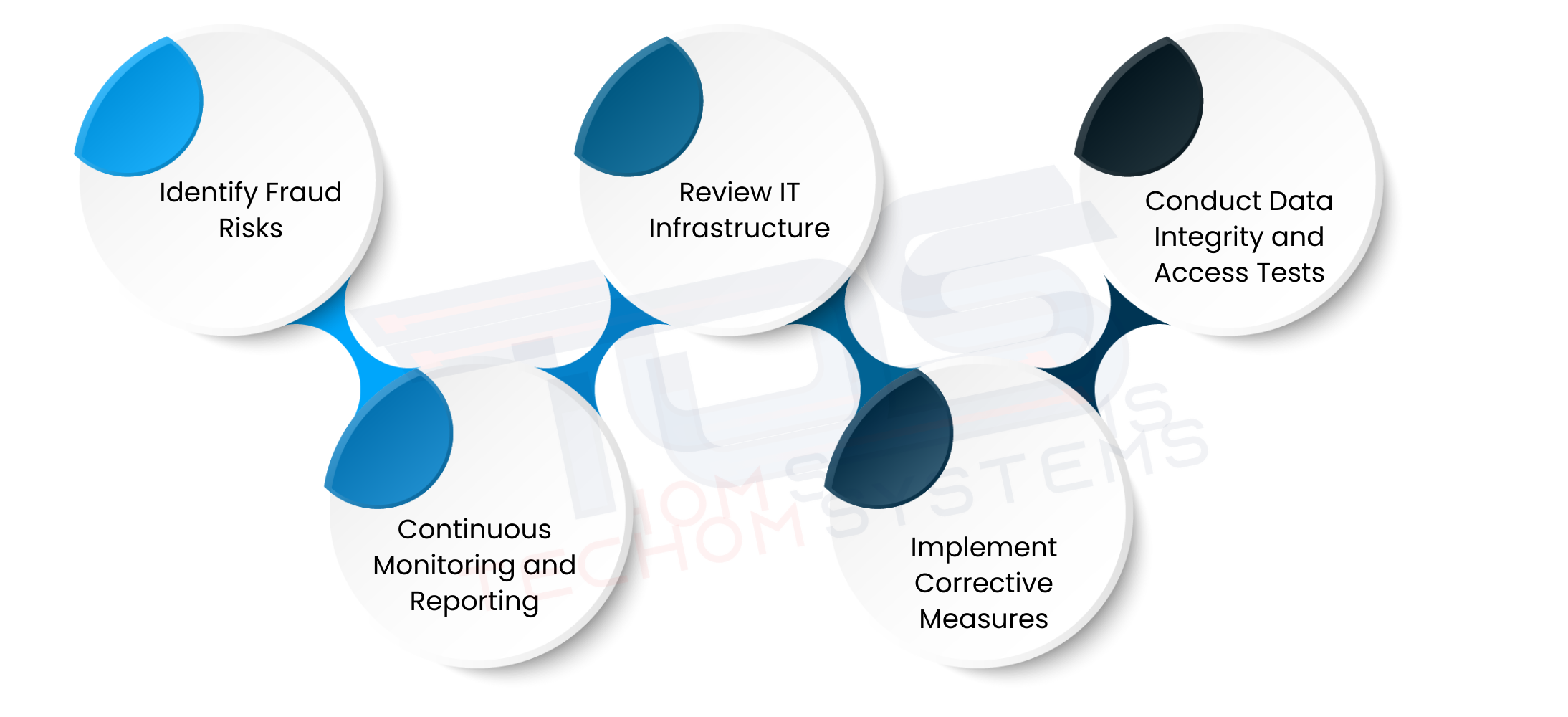

Step By Step IT Audit For Fraud Detection

Even the most careful businesses can face hidden risks. Imagine a growing company where multiple employees manage finances, IT systems and customer data. A small oversight, like improper access permissions or outdated software, could allow fraud to occur without anyone noticing.

A step by step IT audit for fraud detection helps uncover these risks, secure critical information and give business owners confidence that their systems are protected. Below are the key steps businesses can follow to conduct an effective IT audit for detecting fraud and safeguarding their operations:

Step 1: Identify Fraud Risks

Start by understanding where your business is most vulnerable. For example, consider a company where multiple employees handle payments and data entry. Certain processes or access points may be more prone to manipulation or mistakes. Mapping these areas allows businesses to focus audit efforts on the most critical points and prevent issues before they escalate.

Step 2: Review IT Infrastructure

Next, examine servers, databases and network systems for weaknesses. Outdated software, unpatched systems or unsecured devices can become easy targets for fraud. Performing an IT audit to prevent device hacking ensures that all systems and devices are secured against unauthorized access. For example, a network without proper firewalls could be vulnerable. Regularly reviewing infrastructure keeps systems up to date and fully protected.

Step 3: Conduct Data Integrity and Access Tests

Ensure that only authorized personnel can access sensitive information. Imagine a situation where financial spreadsheets are accessible to multiple employees, increasing the risk of tampering. Data integrity tests verify that records are accurate and access is limited, reducing the chance of fraudulent activity.

Step 4: Continuous Monitoring and Reporting

Use IT audit tools to track unusual activities and generate alerts. For example, a sudden change in transaction patterns or repeated login failures can indicate a potential problem. Regular reporting gives businesses actionable insights to respond quickly, keeping operations safe and secure.

Step 5: Implement Corrective Measures

Finally, address any vulnerabilities found during the audit. Update systems, strengthen access controls and train employees on best practices. For instance, providing staff training on secure password practices or fraud awareness can prevent future incidents. Implementing corrective measures ensures that risks are minimized and the organization remains protected.

Are you noticing unusual transactions, unexpected system activity or gaps in your business controls? Book a free consultation with TECHOM Systems today and let our experts guide you through a step by step IT audit to uncover hidden risks and protect your business effectively.

Best Practices For IT Audits To Detect Fraud

Preventing fraud is easier when you follow proven strategies. Many businesses struggle because they only check systems occasionally or rely on outdated methods. Implementing these best practices for IT audits to detect fraud can make your processes smoother, more effective and keep your business safe. The table below shows simple steps and the benefits they bring:

| Best Practice | What It Means | Why It Helps |

|---|---|---|

| Schedule regular IT audits | Check your systems consistently instead of once a year | Catch issues early and keep your business continuously protected |

| Use analytics and AI based tools | Use technology to spot unusual patterns and activities | Detect potential fraud faster and more accurately |

| Train employees on data security and fraud prevention | Teach staff how to handle sensitive data securely | Reduce mistakes and strengthen your internal controls |

| Partner with professional IT audit services | Get guidance from experts who know the system inside out | Ensure a thorough audit and expert advice to manage risks |

Following these practices ensures your business stays secure, compliant and prepared to prevent fraud before it happens. Regular IT audits also help prevent data breaches in business systems, keeping your sensitive information safe and protected.

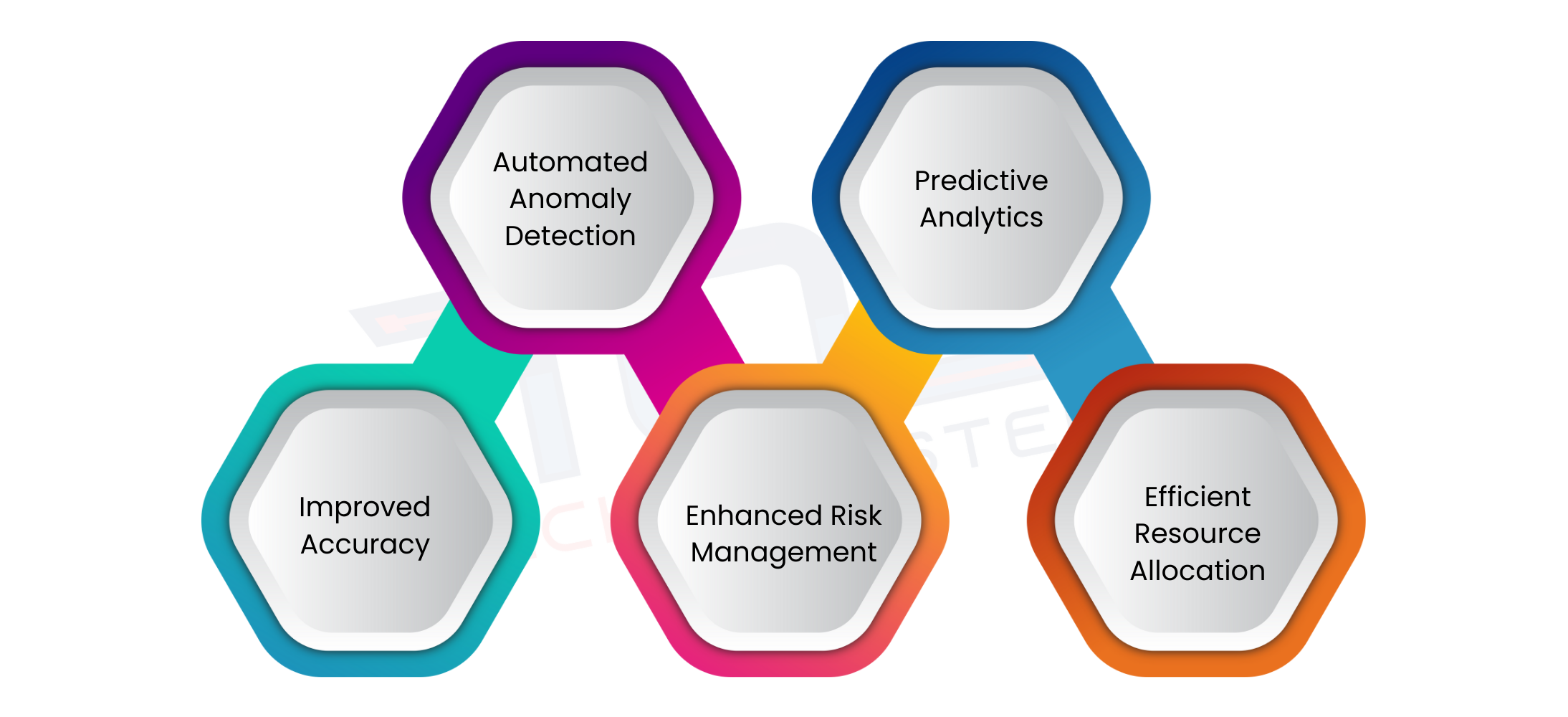

The Role Of AI In Preventing Business Fraud

Businesses today face increasingly sophisticated fraud attempts. Even the most careful organizations can struggle to detect irregularities in financial transactions or unusual system activities. Integrating artificial intelligence with IT audit for detecting fraud in businesses helps companies identify risks faster, respond proactively and secure sensitive data effectively. Here are the keyways AI enhances fraud detection and complements traditional IT audits:

1. Automated Anomaly Detection

AI can continuously monitor financial transactions, system logs and user activities. For example, if an employee suddenly transfers large sums outside regular patterns or logs in at unusual hours, AI can flag this instantly. This complements fraud detection through IT audits by providing real time alerts and actionable insights, allowing businesses to respond immediately and prevent potential losses.

2. Predictive Analytics

Machine learning algorithms can study historical fraud cases, employee behaviors and system activity to predict where future risks might occur. Imagine a retail company noticing that fraudulent refund requests often happen in certain accounts or at specific times. AI can highlight these trends, enabling auditors to focus on high risk areas and strengthen preventive measures.

3. Improved Accuracy

Manual audits can sometimes miss subtle irregularities in large datasets. AI enhances accuracy by scanning vast volumes of data without fatigue. When combined with professional IT audit services, businesses can ensure that all irregularities are investigated efficiently, reducing the chances of missed fraud and building stronger internal controls.

4. Enhanced Risk Management

AI tools help monitor access permissions, track suspicious activities and protect sensitive information. For instance, AI can detect unauthorized attempts to access customer records or sensitive financial data. Integrating AI with preventing fraud in businesses with IT audits makes the process proactive, ensuring vulnerabilities are addressed before they escalate.

5. Efficient Resource Allocation

AI automates routine monitoring and analysis, freeing auditors to focus on critical areas. This ensures that high risk areas get more attention while repetitive tasks are handled automatically. Businesses save time, reduce human error and make their IT audit process more efficient and thorough.

By leveraging AI alongside IT audit for detecting fraud in businesses and partnering with TECHOM Systems, companies can strengthen security, enhance decision making and stay ahead of potential threats. Using updated technology ensures not only early detection but also long term protection, maintaining trust with clients and safeguarding sensitive business data.

Free Guide For You: Cost Reduction Strategies In Business With IT Health Checkup

Choose TECHOM Systems For IT Audit Consulting Services

When it comes to protecting your business from fraud and ensuring your IT systems are secure, choosing the right partner for IT audit consulting services makes all the difference. Effective audits require expertise, thorough analysis and actionable recommendations. Partnering with TECHOM Systems ensures your business gets professional guidance every step of the way. Here are some key reasons to choose us:

- Expert IT Audit Services

Our team has extensive experience in conducting IT audits for detecting fraud in businesses. We provide a structured and detailed review of your systems to uncover hidden risks and secure critical information. - Step by Step Audit Process

We follow a clear step by step IT audit for fraud detection, making the process simple, effective and tailored to your business needs. Each step is designed to identify vulnerabilities and provide practical solutions. - Advanced Tools and Analytics

We use the latest analytics and AI based tools to monitor systems, detect unusual patterns and flag potential threats early. This ensures proactive fraud detection and improved security for your business. - Employee Training and Guidance

TECHOM Systems helps train your employees on best practices for data security and fraud prevention. Educated teams reduce the risk of errors and strengthen internal controls. - Continuous Support and Recommendations

Our IT audit consulting services go beyond just delivering a report. We provide actionable recommendations, ongoing support and guidance to help businesses implement corrective measures and maintain strong security. - Trusted Partner for Long Term Security

Choosing TECHOM Systems means your business gains a reliable partner committed to protecting your finances, sensitive data and reputation. Preventing fraud in businesses with IT audits becomes easier when you have experts guiding every step.

Partner with TECHOM Systems for professional IT audit consulting services and ensure your business stays secure, compliant and protected from fraud. You can learn more about our services here…

Frequently Asked Questions

#1: What Are The 5 C’s Of Audit?

Ans: The 5 C’s of audit are Competence, Confidentiality, Consistency, Completeness and Clarity. They guide auditors to review business records accurately, maintain privacy, follow consistent procedures, ensure full documentation and communicate findings clearly.

#2: What Is The Role Of Auditing In Fraud Detection?

Ans: Auditing helps identify unusual financial transactions, weak internal controls and high risk areas early. This allows businesses to detect fraud, reduce losses and maintain trust with clients and employees effectively.

#3: What Is The Purpose Of The IT Audit?

Ans: The purpose of IT audit for detecting fraud in businesses is to examine IT systems, secure sensitive data, identify vulnerabilities, ensure compliance with policies and minimize risks of fraud or cyber threats.

#4: How Does TECHOM Systems Help In IT Audits?

Ans: TECHOM Systems provides expert IT audit consulting services using advanced tools and updated technology. They help uncover hidden risks, prevent fraud, improve system security and guide businesses to implement corrective measures efficiently.

Final Thoughts

In this blog, we explored how IT audit for detecting fraud in businesses helps companies uncover hidden risks, secure sensitive data and prevent financial losses. We discussed why IT audits matter, the importance of regular checks and the benefits of following best practices. You also learned a step by step IT audit for fraud detection, how to identify vulnerabilities, monitor unusual activities and implement corrective measures effectively.

By applying these insights and partnering with professionals like TECHOM Systems, businesses can stay proactive, protect their finances, maintain trust with clients and employees and ensure long term operational security. The key takeaway is that regular audits, proper monitoring and expert guidance make detecting and preventing fraud manageable and reliable.

If you are unsure whether your business is fully protected or notice unusual system activity, Contact TECHOM Systems to get expert guidance on implementing a robust IT audit and securing your operations effectively.

Technical Specialist with 3+ years of experience in implementing IT infrastructure, AI-driven automation and supporting digital innovation. His work focuses on helping businesses adopt reliable, future ready technologies that improve performance and protect critical data. He brings a practical, solution-focused approach to every IT challenge.